In payments, you will hear references to real accounts and virtual accounts. But what’s the difference between them and does it even matter? What are the benefits and drawbacks?

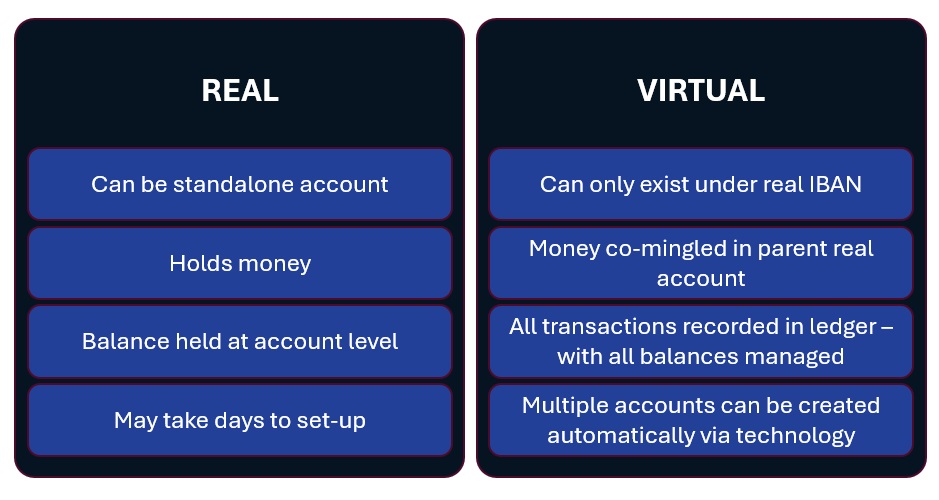

At its simplest, a real account holds real money, but a virtual account is a ledger recording all the transactions happening in a real account.

Real Account

A real account is an account that holds money. A real account will have its own IBAN.

This type of account is used in several different scenarios, such as:

A corporation with different company entities will want a separate account for each of the company entities it owns.

Similarly, a company that trades in different countries would want a separate account for each currency they trade in.

In both cases, with separate account details the corporation does not need to track transactions and balances separately.

Virtual Account

Virtual accounts exist under a real parent account. A virtual account itself doesn’t hold money but works as a reference to the money held within its “umbrella” real account.

Each virtual account can have its own IBAN – though this is actually a virtual IBAN. Funds sent to this virtual IBAN will be co-mingled within the real parent account but because of the ledger, enables the real parent account to separate the transactions and balances for each of the virtual accounts.

Which is better: Real or Virtual?

There’s no simple answer for this as it depends on the situation.

Advantage of Virtual accounts within cross-border payments?

Virtual accounts help facilitate cross-border payments by providing an IBAN in the local currency where you wish to send or receive money. In these cases, creating a real account is not realistic given time, administration and cost.

Are all Virtual accounts the same?

Not all virtual account providers are the same. Universe Payments ensures that all Virtual Accounts are personalised with your company name.